How Much Indiana Homeowners Pay in Property Taxes Each Year

For years I loved wolf pies and only a few years ago I started experimenting with making my own unique flavors. I made pies of red velvet, Funfetti, oranges, lemons, wedding cakes, cherries, and even German chocolate. Each of them has its own unique glaze,…

The Christian Lent season officially began a few days ago on Holy Wednesday, culminating on Easter Sunday, April 17th. Unlike Christmas, which is a fixed date each year, Easter is based on the lunar calendar and falls on the Sunday after the first full moon after March 21st. East…

In April, the Centers for Medicare and Medicaid Services should decide whether to cover a new and expensive drug for Alzheimer’s disease, Aduhelm, for those on Medicare. In January, it issued a proposed coverage decision that would allow Medicare coverage for Alzheimer’s patients only if they are e …

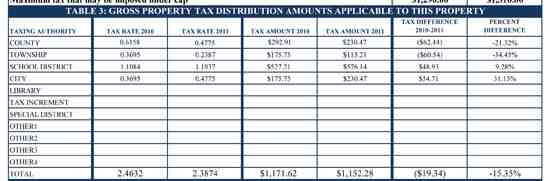

What county pays the highest property taxes?

All six counties with the highest average property tax payments have bills in excess of $ 10,000 – Bergen, Essex and Union counties in New Jersey, and Nassau, Rockland and Westchester counties in New York. Read also : Indiana Department of Health hosting vaccine clinic in Warrick Co.. All six are near New York City, as is the next tallest, Passaic County, New Jersey ($ 9,881).

Who has the highest property tax in the US? Although most of the major cities with the highest effective property tax rates are in Texas, Milwaukee ranks first with an effective property tax rate of 2.17 percent, which is twice the effective national property tax rate of 1.03 percent .

What counties have the highest tax rates?

Top 10 Countries with the Highest Income Tax Rates – Trade Economy 2021: To see also : Indiana Opens as Big Favorite for Sunday’s Home Game Against Minnesota.

- Ivory Coast – 60%

- Finland – 56.95%

- Japan – 55.97%

- Denmark – 55.90%

- Austria – 55.00%

- Sweden – 52.90%

- Aruba – 52.00%

- Belgium – 50.00% (equal)

Which city or county has the highest income tax rate?

1. Bridgeport, Connecticut. As one of the richest cities in America, Bridgeport has the highest overall tax rate in the country. Wealthy taxpayers earning more than $ 150,000 a year are on the hook for up to 22% of state and local taxes.

Which county has the lowest property tax?

Apache County collects only 0.18% of the value of each property each year from property taxes, while Pima County charges more than five times the tax rate of 0. See the article : State officials: Bird flu found at 4th Indiana turkey farm.96% of property values.

Where Are property taxes the lowest?

| Rank | state | Real estate tax rate |

|---|---|---|

| 1 | Hawaii | 0.28% |

| 2 | Alabama | 0.41% |

| 3 | Colorado | 0.51% |

| 4 | Louisiana | 0.55% |

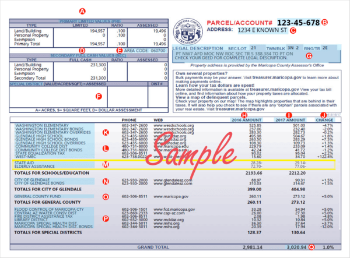

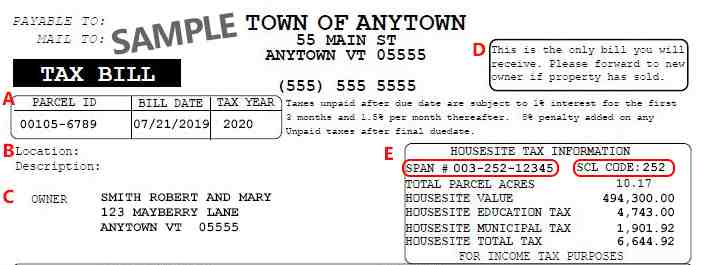

How are property taxes paid in Indiana?

Indiana property taxes are paid in arrears and are usually due in two installments a year – on May 10 and November 10. Valuation – the official act of discovering, inventorying and valuing assets for ad valorem tax purposes.

How Many Months Property Tax Is Charged At Indiana Closing? It will be charged at least one year in advance plus two months of homeowner’s insurance premium. In addition, closures are subject to taxes equal to approximately two months above the number of months that have elapsed in the year. (If six months have passed, eight months of tax will be charged.)

What age do you stop paying property taxes in Indiana?

He turned 65 or older by December 31 of the previous year.

What is the homestead exemption in Indiana?

The standard household deduction is either 60% of the appraised value of your property or a maximum of $ 45,000, whichever is less. The additional household deduction is based on the appraised value of your property and is: 35% of the appraised value of the property that is less than $ 600,000.

What is the property tax exemption for over 65?

Age 65 or older and disability exemptions: Individuals age 65 or older or owners of residential households with disabilities qualify for a $ 10,000 exemption for school district taxes, with an exemption of $ 25,000 for all homeowners.

Do seniors have to pay property taxes in Indiana?

Senior citizens, like all homeowners in Indiana, can claim a tax deduction if their home serves as their primary residence. … This exemption provides for a deduction of the estimated value of the property. The amount of the deduction is equal to either 60 percent of the appraised value of the home or a maximum of $ 45,000.

How can I lower my property taxes?

How to reduce property taxes: 7 tips

- Limit home improvement projects. …

- Explore the values of neighboring houses. …

- Make sure you qualify for tax exemptions. …

- Participate in your assessor’s pass. …

- Check your tax account for inaccuracies. …

- Get a second opinion. …

- File a tax appeal.

Who is exempt from paying property taxes in Michigan? Exemption from property tax for real estate owned and used as a household by a veteran’s disabled or unmarried, veteran’s surviving spouse.

How can I pay my property taxes less in California?

Therefore, one of the primary ways you can reduce your overall tax burden is to reduce the appraised value of your home – in other words, filing a complaint claiming that its appraised value is actually less than the one assigned to it by the appraiser.

How long can you go without paying property taxes in California?

Your taxes may remain unpaid for up to five years after non-payment of taxes, at which point your assets become subject to sale.

Can you lower your property taxes in California?

If a homeowner thinks there has been an inaccurate assessment of their home, they may be able to reduce property taxes in California by filing a complaint. However, before moving forward with a formal complaint, homeowners should talk to their local county appraiser’s office.

Can you pay property taxes monthly in California?

The new program allows taxpayers to pay annual property taxes in monthly installments. County taxpayers can use Easy Smart Pay for monthly annual property tax payments.

At what age do you stop paying property taxes in Florida?

Certain property tax benefits are available to people over the age of 65 in Florida. The right to exemption from property tax depends on certain requirements. Information can be obtained from the property assessment office in the county where the applicant has a garden or other real estate.

Do seniors have to pay property tax in Florida?

Exemption for the elderly is an additional property tax relief available to homeowners who meet the following criteria: The property must qualify for an exemption from possession. At least one homeowner must be 65 years old as of January 1st.

How much is the senior exemption in Florida?

Supplementary household exemption for low-income seniors 65 years The lesser-known supplementary exemption for households will allow an ADDITIONAL $ 25,000.00 – $ 50,000.00 to be deducted from the assessed / taxable value of the property.

Who is exempt from paying property taxes in Florida?

Exemption from Property: Any person who has legal or equitable ownership of a property in the State of Florida and who resides in it and makes it their permanent home in good faith is entitled to an exemption from property of up to $ 50,000. The first $ 25,000 applies to all property taxes.

What is considered personal property in Indiana?

Includes equipment used in revenue generation or held as an investment; billboards; equipment foundations; and all other tangible assets other than real estate.

Comments are closed.